Who should precede GST Invoices and what are the compulsory fields a GST Invoice concedes and why?

The Goods and Services Tax (GST) subsumes many indirect taxes which were imposed by Centre and State such as excise, VAT, and service tax. It is levied on both goods and services sold in the country where- GST return filing reduces the descending effect of the tax, essential in inception for registration, produce a scheme for small businesses, safe and straightforward online method, lesser in docility, individualized treatment for E-commerce supervisors, increased in the efficiency of logistics and regulated disorganized sector under GST.

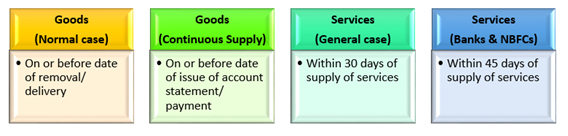

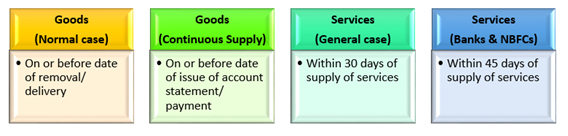

If you obtain a GST listed business, you require providing GST-complaint invoices to your clients for the sale of goods and services. Your GST listed merchants will provide GST-compliant buying invoices to you. You can personalize your bill with your company’s logo. A tax invoice is generally assigned to load the tax and pass on the input tax credit. A GST return filing Invoice must have the subsequent necessary fields-

- Invoice figures and days

- Customer title

- Transportation and billing location

- Client and taxpayer’s GSTIN

- Area of supply

- HSN / SAC code

- Item details, i.e. classification, quantity (number), unit (meter, kg etc.), the total amount

- Taxable value and discounts

- Rate and volume of taxes, i.e. CGST/ SGST/ IGST

- Whether GST is payable on the reverse charge basis

- Signature of the supplier

Types of GST Return Filing Invoices

Bill about Supplies

A bill of a stock is related to a GST Return Filing invoice except for the statement of supply does not include any tax expense as the seller cannot impose GST to the customer. It gets issued in cases where tax cannot charge: The Registered person is trading exempted goods/services and who has opted for "composition scheme."

According to Notification No. 45/2017 – Central Tax on 13th October 2017 If a recorded person is supplying taxable and excused goods/ services to an unregistered person, then he can originate a single "invoice-cum-bill of supply" for all before-mentioned stocks.

Aggregate Invoice

If the utility of multiple bills is less than Rs. 200 and the Buyer are unregistered; the dealer can issue a total or bulk invoice for the various invoices on a daily base.

Debit and credit note:

A debit note is issued by the seller when the amount payable by the Buyer to seller increases and when Tax invoice has a lower taxable value.

A credit note is issued by the seller when the cost of invoice decreases and Tax invoice has a higher taxable value, Buyer refunds the goods to the supplier, Services are found to be deficient.

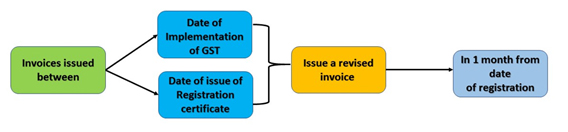

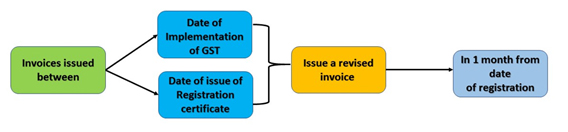

Revision of invoices issued before GST Returns Filing?

You can analyze invoices appeared before GST Return Filing. Under the GST administration, all the dealers must beg for provisional delegation before getting the changeless registration certificate. As a dealer, you need to issue an updated invoice against the invoices previously issued. The revised invoice has to be issued within one month period from the date of issuance of the registration certificate.

Who all are required and doesn't need to file GST Return Filing?

All GST registration owners who is chargeable under the GST Act, 2017 is to file GST returns as based on the nature of their business. Under GST, GST returns that include:

- Purchases (Procurements)

- Sales (Exchanges)

- Output GST (Ongoings)

- Input tax credit (GST paid on gains)

Business turnover is below the entrance limit of Rs. 40 lakh doesn't require filing GST returns, and the same is for North-Eastern and hilly regions with the turnover below Rs. 20 lakhs,